carried interest tax changes

November 1 2021. Any ability for a service provider to receive LTCG rates from a partnership interest acquired in exchange for providing services and the deferral of some or all of the income until an exit event.

Proof Of Auto Insurance Template Free Car Insurance Insurance Printable Card Templates Free

The IRA now heads to the House for consideration with.

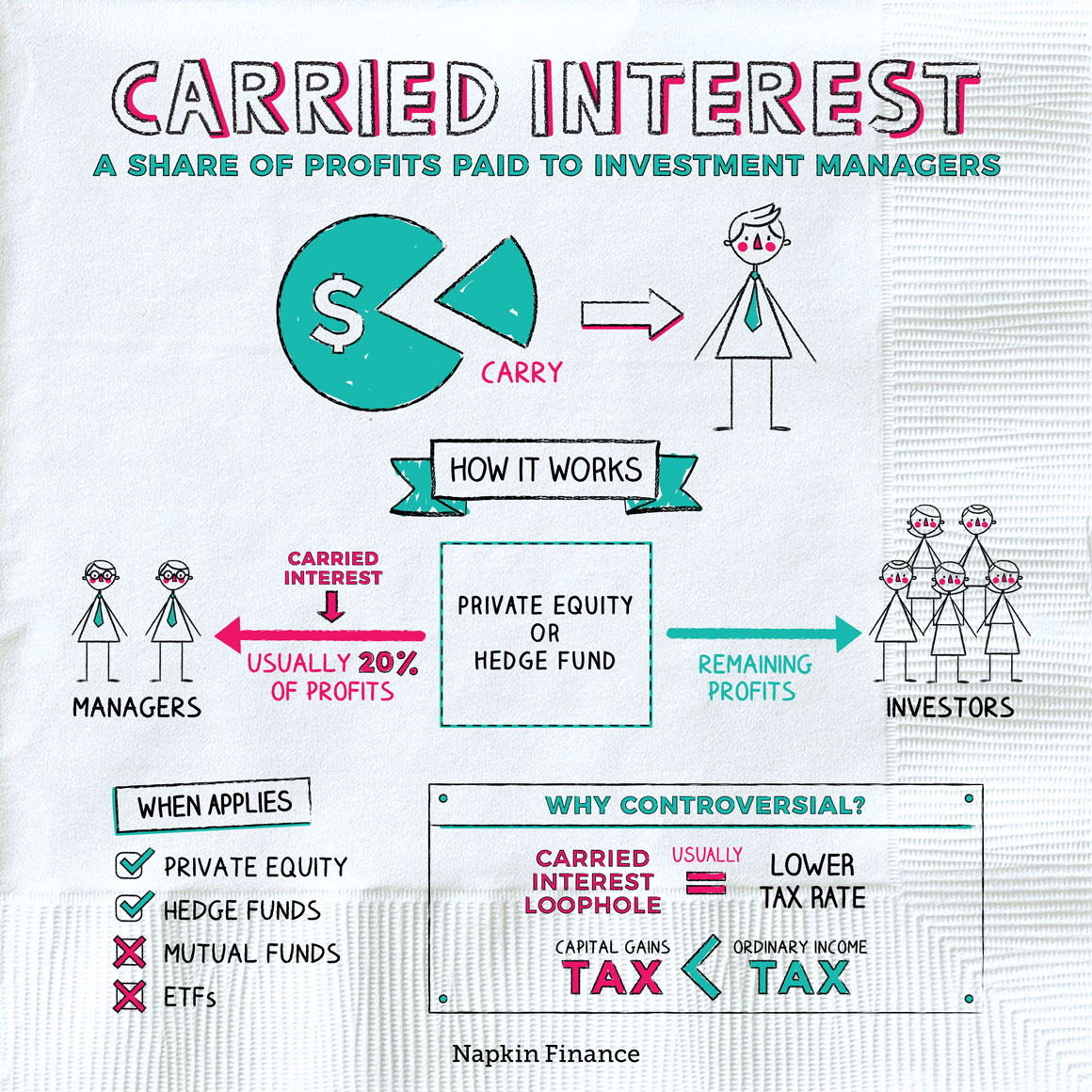

. The current tax treatment of carried interest is the result of the intersection of several parts of the Internal Revenue Code IRCrelating to partnerships capital gains qualified dividends and property transferred for. Dropping the carried interest tax provision from the Inflation Reduction Act cost 14 billion in projected revenue but Schumer made up for it by adding an excise tax on stock buybacks that will. Carried interest is a loophole in the United States tax code that has stood out for its egregious unfairness and stunning longevity.

Net applicable partnership gain means net long-term. Carried interest has long been the target of lawmaker scrutiny. 2022 IRA proposed changes to carried interest taxation.

The proposed legislation would among other things significantly expand the scope of Section 1061 1. While not fully satisfying opponents of tax-favored carried interests the. Senate Majority Leader Chuck Schumer D-NY and Sen.

While the Stop Wall Street Looting Act a comprehensive bill first introduced in 2019 never made it out of committee in a Republican-controlled Senate the current legislative movements in a now Democrat-controlled Senate and House have gained significant momentum. Carried interest tax increase to be removed from bill among other changes Sens. Congress has indicated that it desires to change the law to further close the carried interest loophole ie.

In the final version of the bill the proposed changes to the carried interest have been gutted leaving the 2007 legislation in place with a three-year holding period for most carried interest holders and the significant Code Section 1231 carve-out for real estate. Section 1061 was. On July 27 2022 US.

A discussion of the key tax provisions in the current draft of the Bill is set forth below. Kyrsten Sinema D-Ariz and Mitt Romney R-Utah are seen Thursday during a Senate vote in the Capitol. At most private equity firms and hedge funds the share of.

Ii create a new corporate. The significant tax changes to the treatment of carried interest introduced in this bill track the mark-up of the Build Back Better Act that came out of the House Committee on Ways and Means last September 2021. Under this proposed bill.

Code Section 1061 was enacted in 2017 to place limits on the ability of carried interest arrangements to be eligible for preferential long-term capital gain LTCG rates instead of higher ordinary. The Inflation Reduction Act of 2022 IRA has taken a step forward as the Senate completed its deliberation and passed the bill on August 7. While in the Senate a few alterations were made to the tax provisions including the removal of any changes to the taxation of carried interests.

Arguments to change the tax treatment of carried interest are often based on the economic principles of efficiency. I change the tax treatment of carried interests. Joe Manchin D-WVa announced an agreement to add the Inflation Reduction Act of 2022 to the FY2022 budget reconciliation bill and vote in the Senate next week.

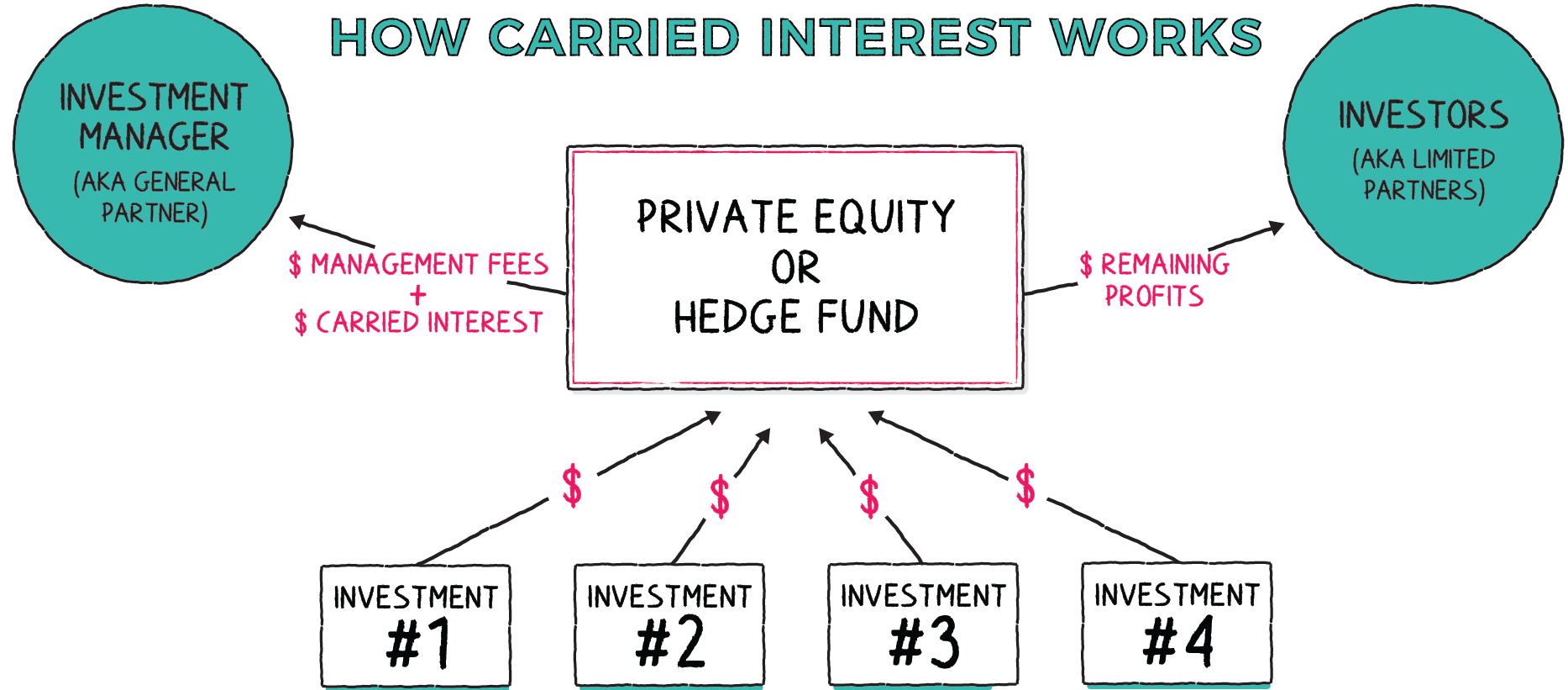

But private equity firms spend millions of dollars a year on lobbyists who fight any effort to change how carried interest is taxed. The recently proposed Inflation Reduction Act of 2022 includes a proposal the carried interest proposal to amend the rules under section 1061 of the Internal Revenue Code of 1986 as amended the Code 1 relating to the taxation of the carried interest or promote earned by investment managers. Carried interest is the percentage of an investments gains that a private equity partner or hedge fund manager takes as compensation.

If it passes the changes to the carried interest provision along with the establishment of a corporate minimum tax rate of 15 would help fund the development of renewable energy projects. Carried interest rule changes could have a negative affect on the venture industrys inclusion. 6 hours agoThe 725-page revival called the Inflation Reduction Act of 2022 the Act contains tax proposals that.

Under the 2022 IRA if one or more applicable partnership interests are held by a taxpayer at any time during a taxable year the taxpayers net applicable partnership gain for the taxable year is treated as short-term capital gain. In his must-read new book Post Corona Scott Galloway calls Section 1202 a tax law that. Lawmakers said that the Joint Committee on Taxation has estimated that over the 10-year budget window the Bill would generate 313 billion from the new corporate book minimum tax and 14 billion from changes made to the taxation of carried interests.

Typically the richest of. The current three year holding period required to achieve long-term capital gain treatment for carried interest payable in.

Democrats Ready Carried Interest Tax Hike After 15 Year Lobbying Campaign In 2022 Democrats Joe Manchin Obama Campaign

Carried Interest In Venture Capital Angellist Venture

What Is E Way Bill Under Gst Goods And Services Internet Usage Goods And Service Tax

Bed Bath Beyond Followed A Winning Playbook And Lost

The Impacts Of Us Tax Reform On Canada S Economy Business Council Of Canada

How Does Carried Interest Work Napkin Finance

Rich Wall Streeters Face Shock Tax Hike While Rest Of Wealthy Escape The Washington Post

Carried Interest Tax Loophole Part Of Manchin Inflation Bill

Carried Interest Taxation Under The Inflation Reduction Act

Internal Auditors Must Consider Different Aspects Of A Business Business Performance Success Business Accounting And Finance

Pe Distribution Waterfalls And Their Impact On Client Returns Icapital

How Does Carried Interest Work Napkin Finance

U S Home Prices Hit New Record Of 416 000 In June As Sales Continued To Slide

What Closing The Carried Interest Loophole Means For The Senate Climate Bill Npr